According to a new survey by the National Association of Home Builders (NAHB), builders use of incentives which are options or upgrades at a reduced price or free to the owner has been reduced to figures before the boom or bust era indicating a normalcy of the housing market. The report which is produced by the NAHB’s Economic and Housing Policy Group indicates that incentives have now declined the point of being roughly consistent with industry practice before the 2003-2006 boom period and severe downturn that followed it.

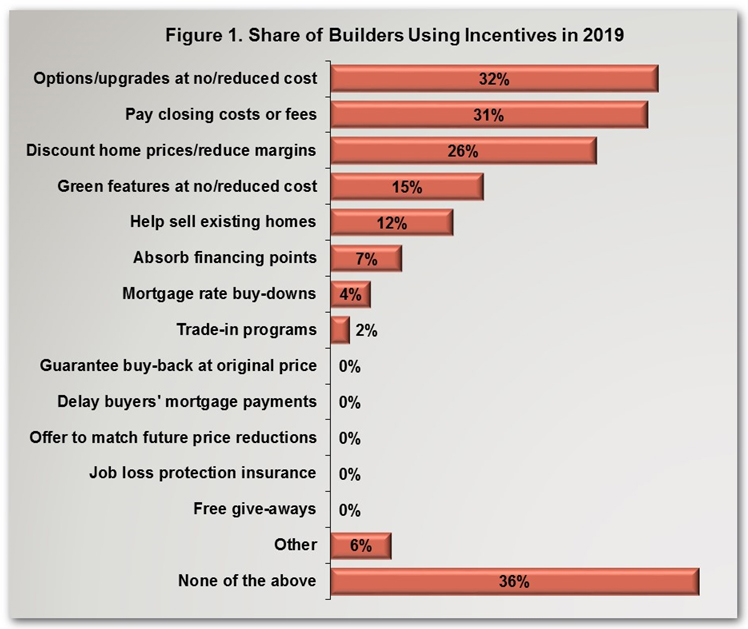

NAHB tracks incentives in their NAHB/ Wells Fargo Housing Market Index (HMI). The results of the 2018 survey indicates that the most common incentive that are being offered by builders would be upgrades at no cost at 32%. This is followed by the paying of closing costs (31%) and discounted home prices (26%). NAHB indicates that green incentives are not included in this survey and has been grouped into another category since 2012.

What is important in the survey is that 36% of all builders stated that there are not offering any incentives at all. NAHB states “it is notable that the share of builders not using any incentives in 2019 is comparable to the figure in March of 2002—38 percent. In between, the share not using incentives reached a high of 50 percent in the middle of 2003 (when annual housing starts broke above the 1.8 million mark for the first time since 1986 where they remained throughout the 2003-2006 boom), and a low of 14 percent at the end of 2008 (when starts dipped below 1.0 million for the first time since World War II, where they lingered until 2014).” One of the main reasons that builder’s state there was not a need for incentives is that the market is strong enough. The amount of builders that have indicates such has increased from 18% in 2012 to 47% in 2019.

NAHB states in their conclusion the rationale why builders are not using incentives as often:

“Advertising special incentives to help boost sales has been a normal part of business for many home builders for generations. Since 2000, however, use of these incentives has fluctuated significantly, along with overall activity in the housing market. During the boom period of 2003-2006, when home sales and single-family starts reached all-time highs and a disproportionate share of buyers consisted of speculators looking to flip homes quickly for short-term profit, use of incentives declined. During the subsequent downturn, use of incentives skyrocketed—to the point where over 70 percent of single-family builders were advertising discounted home prices in late 2008/early 2009.

If 2002, before the latest boom and bust cycle, represents a relatively normal period for the U.S. housing market, then use of incentives has returned to normal in 2019. Use of each of the five specific incentives NAHB has tracked in a consistent fashion has now returned to its 2002 level, or to a level that it crossed on its way down from 2002 to the 2003-2005 trough.”

BJD Property Management is a full service NYC property management company servicing NYC. We assist managing all investment properties of all sizes services properties in the 5 boroughs.